Institutional Investors

Despite contrary presumptions, one can assume a general interest of financial investors in the long-term development of their portfolio companies, as this is usually accompanied with a positive value development. Especially buy-and-build-strategies significantly contribute to growth scenarios and have a high macroeconomic importance. Nevertheless, most of the financial investors have limited holding periods and the regular profitable sale of portfolio companies are part of the business model. An experienced M&A-consultant has to understand the way of thinking of private equity investors and to consider it adequately in the process design.

Institutional Investors

What makes us different:

Orientation to the midset and targets of financial investors

Extremely high personal commitment – consistant support on partner-level

Professional process management with highest quality standards

Profound industry know-how and network contacts

Long-term experience in cross-border transactions

Global coverage of potential buyers and targets through international network

“In cooperation with Dr. Ulrich we quickly realised that she understands our mindset as financial investor and knew how to mediate between the transaction parties. Thanks to her support, the transaction was closed successfully in a short time.“

Olaf Meier

(CEO Callista Private Equity)

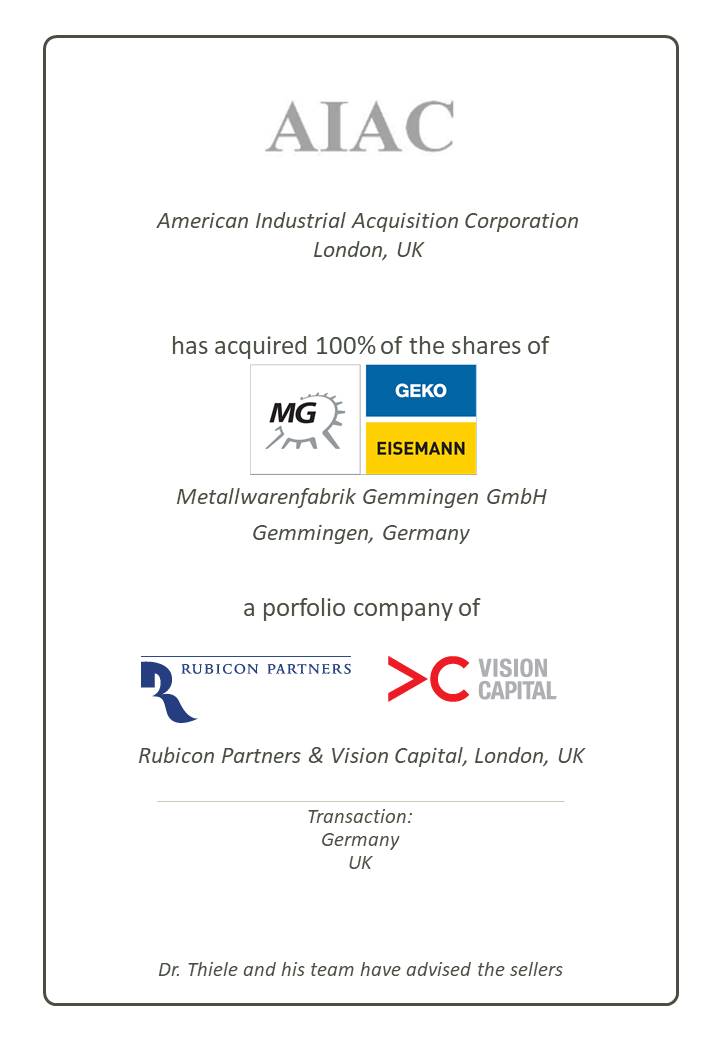

References*:

* Contains reference projects of former occupations of Dr. Thiele/Dr. Ulrich

Institutional Investors

Despite contrary presumptions, one can assume a general interest of financial investors in the long-term development of their portfolio companies, as this is usually accompanied with a positive value development. Especially buy-and-build-strategies significantly contribute to growth scenarios and have a high macroeconomic importance. Nevertheless, most of the financial investors have limited holding periods and the regular profitable sale of portfolio companies are part of the business model. An experienced M&A-consultant has to understand the way of thinking of private equity investors and to consider it adequately in the process design.

What makes us different:

Advisory services from entrepreneurs for entrepreneurs

Support on partner-level with extremely high commitment round the clock

Coaching of shareholders and management in all matters relevant for the transaction

Tight and efficient process management in order to protect (company) resources

Long-term experience in Langjährige Erfahrung in intercultural transactions

Global access to potential buyers through international network

“In cooperation with Dr. Ulrich we quickly realised that she understands our mindset as financial investor and knew how to mediate between the transaction parties. Thanks to her support, the transaction was closed successfully in a short time.“

Olaf Meier

(CEO Callista Private Equity)

References*:

* Contains reference projects of former occupations of Dr. Thiele/Dr. Ulrich

Institutional Investors